There is much debate as to whether investors in early stage companies benefit from reviewing financial projections and business plans. The earlier the stage of the company, the harder it is to “predict” what the future pathway will look like. Without a having an opportunity to review a business plan however, it is difficult for investors to understand how the company intends to spend the funds raised and what it hopes to accomplish with those funds.

There is much debate as to whether investors in early stage companies benefit from reviewing financial projections and business plans. The earlier the stage of the company, the harder it is to “predict” what the future pathway will look like. Without a having an opportunity to review a business plan however, it is difficult for investors to understand how the company intends to spend the funds raised and what it hopes to accomplish with those funds.

In reviewing plans/projections from early stage companies, I like to be able to answer the following three questions:

- What will be the monthly net spend? – the BURN

- How long will this funding last? – the RUNWAY

- What will this raise enable the company to accomplish? – the METRICS

Understanding the components of the monthly BURN provides insight as to how the CEO plans to grow the team, allocate any marketing dollars, build out a tech team, etc. This projection should include the efficacy of the funds to be spent – will it result in an increase in user growth or engagement, a completed pilot or other measure critical to the industry vertical represented. If the company is generating or anticipating generating revenue near term, the “go to market” strategy can be evaluated based on the underlying assumptions in the model. Understanding whether these revenue assumptions are based on a pilot that the company has run, industry metrics or just a best guess will help the investor determine the confidence level they want to assign to any projections. As a company matures, so should the financial sophistication of the projections. Understanding the RUNWAY and the METRICS will help the investor evaluate whether the proposed funding will enable the company to reach an inflection point to either attract additional funding or become cash flow positive. Unfortunately many startups run out of money before achieving the necessary metrics.

I once had a CEO tell me that they were not going to “waste their time” putting together a financial model for investors. I could not agree more – if the CEO is creating a business model simply for investors, it is pretty useless. I want the CEO to share with me the model they are actually using to run their business. Reminds me of the famous words of Yogi Berra – “If you don’t know where you are going, you’ll end up someplace else”. Another red flag for me is the CEO who outsources the financial model and never really owns their numbers. I’ll trade a multi-color picture perfect chart for a somewhat messy but real excel spreadsheet any day.

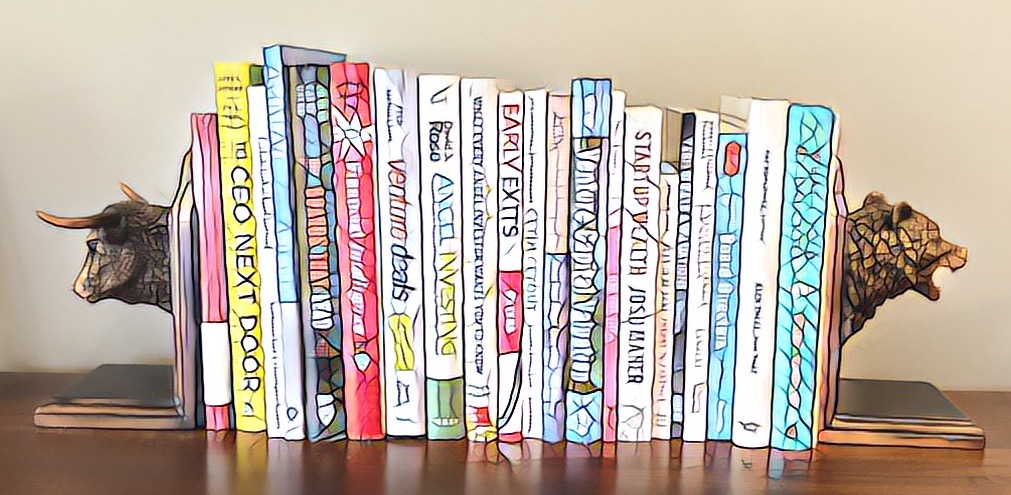

For investors and founders looking to increase their comfort level in understanding financial statements and projections, I recommend:

Financial Literacy – by Richard A. Lambert, Professor of Accounting at the Wharton School of the University of Pennsylvania

Financial Intelligence – by Karen Berman and Joe Knight

Although both of these books are targeted primarily at understanding the financial statements of public companies, many of the concepts apply to startups as well. As early stage companies mature and begin to become more financially sophisticated, this information will prove even more useful.

The New Year is great time for reflection, especially when entering a new decade. Looking back over the past ten years, the ecosystem of Angel Investing has experienced a number of innovations, seen new players enter the market and even added some new terms to the lexicon. A few highlights include:

The New Year is great time for reflection, especially when entering a new decade. Looking back over the past ten years, the ecosystem of Angel Investing has experienced a number of innovations, seen new players enter the market and even added some new terms to the lexicon. A few highlights include: Over the past few months, I have had several people reach out to me to ask my advice as to how to become an angel investor. So I thought it timely to put pen to paper to provide my take as to how to consider investing in this asset class. There are obviously many approaches to exploring this question; this is just one woman’s view!

Over the past few months, I have had several people reach out to me to ask my advice as to how to become an angel investor. So I thought it timely to put pen to paper to provide my take as to how to consider investing in this asset class. There are obviously many approaches to exploring this question; this is just one woman’s view! Although long past are the days of racing up and down the aisles of Staples, kids in tow, to acquire all the school supplies on the “list” (probably these days best achieved with a one-click of Amazon Prime), the imminent arrival of the crisp weather of fall always turns my attention to “back to school” thoughts. These days, back to school means reviewing resources to help educate angel investors. Having had the privilege over the past six years to provide leadership to the

Although long past are the days of racing up and down the aisles of Staples, kids in tow, to acquire all the school supplies on the “list” (probably these days best achieved with a one-click of Amazon Prime), the imminent arrival of the crisp weather of fall always turns my attention to “back to school” thoughts. These days, back to school means reviewing resources to help educate angel investors. Having had the privilege over the past six years to provide leadership to the

It’s that time once again to reflect on the prior year and make some resolutions for the next.

It’s that time once again to reflect on the prior year and make some resolutions for the next.