The New Year is great time for reflection, especially when entering a new decade. Looking back over the past ten years, the ecosystem of Angel Investing has experienced a number of innovations, seen new players enter the market and even added some new terms to the lexicon. A few highlights include:

The New Year is great time for reflection, especially when entering a new decade. Looking back over the past ten years, the ecosystem of Angel Investing has experienced a number of innovations, seen new players enter the market and even added some new terms to the lexicon. A few highlights include:

- Angel List – created in 2010 by Naval Ravikant and Babak Nivi as a deal sharing platform, Angel List now serves as a source of talent for the startup community and provides syndication opportunities within the VC community.

- “The Unicorn Club” – coined by Venture Capitalist Aileen Lee in 2013, the term unicorn refers to a privately held startup company with a value of over $1 billion. According to CB Insights, as of the end of 2019 there were more than 400 unicorns and two new categories; a decacorn (valued over $10 billion) and a hectocorn (valued over $100 billion) added to the list.

- The Jobs Act – Signed into law in April 2012 by President Obama, The Jumpstart Our Business Startups (JOBS) Act impacted capital formation, disclosure and registration requirements and introduced Equity Crowdfunding.

- The FPO or Final Private Offering – Investors hoping to be able to participate in the final private financing round of a company prior to an Initial Public Offering were able to pool their funds into special purpose vehicles established to enable them to participate alongside VC firms and other early backers.

- A significant increase over the past ten years in the number of Accelerators providing mentorship, capital, introductions to investors, co-working spaces and other operational services to startups. A great resource of Accelerators and their focus in the NYC area can be found in a list put together by 37 Angels.

- The Rise of the Female Investor – Over the past decade, we have seen a number of new VC Funds and Investment Platforms started by women and focused on investing in women. The list includes Halogen Ventures, SoGal Ventures, Female Founders Fund, BBG Ventures, Portfolia, Golden Seeds Ventures, and Plum Alley among others.

Now it’s time to consult your crystal ball to see what this next decade will bring!

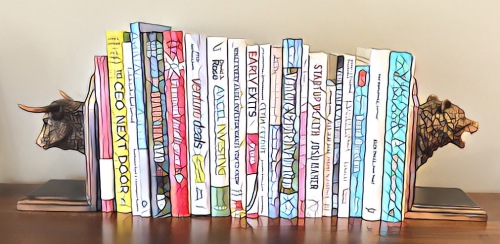

Although long past are the days of racing up and down the aisles of Staples, kids in tow, to acquire all the school supplies on the “list” (probably these days best achieved with a one-click of Amazon Prime), the imminent arrival of the crisp weather of fall always turns my attention to “back to school” thoughts. These days, back to school means reviewing resources to help educate angel investors. Having had the privilege over the past six years to provide leadership to the

Although long past are the days of racing up and down the aisles of Staples, kids in tow, to acquire all the school supplies on the “list” (probably these days best achieved with a one-click of Amazon Prime), the imminent arrival of the crisp weather of fall always turns my attention to “back to school” thoughts. These days, back to school means reviewing resources to help educate angel investors. Having had the privilege over the past six years to provide leadership to the

It’s that time once again to reflect on the prior year and make some resolutions for the next.

It’s that time once again to reflect on the prior year and make some resolutions for the next.

There are a variety of funding options for entrepreneurs to consider as they explore taking in external capital. For investors, understanding the pros and cons of these various funding options and how they fit into a company’s overall funding plan is critical. One option, a Convertible Note, is a hybrid structure that is used as a bridge to a future equity round. In addition to a stated interest rate and maturity date, Convertible Notes will have conversion terms that outline how the notes will be repaid or converted into equity. The amount of equity that a company needs to raise to trigger the conversion of the notes is referred to as the qualified equity financing. Historically, I have seen this form of funding used primarily in pre-seed rounds where the company needs to raise a small amount of capital to get to proof of concept as well as a bridge financing between a Series A and B round in order to provide the company with a bit more runway to get to the metrics required by a Series B investor.

There are a variety of funding options for entrepreneurs to consider as they explore taking in external capital. For investors, understanding the pros and cons of these various funding options and how they fit into a company’s overall funding plan is critical. One option, a Convertible Note, is a hybrid structure that is used as a bridge to a future equity round. In addition to a stated interest rate and maturity date, Convertible Notes will have conversion terms that outline how the notes will be repaid or converted into equity. The amount of equity that a company needs to raise to trigger the conversion of the notes is referred to as the qualified equity financing. Historically, I have seen this form of funding used primarily in pre-seed rounds where the company needs to raise a small amount of capital to get to proof of concept as well as a bridge financing between a Series A and B round in order to provide the company with a bit more runway to get to the metrics required by a Series B investor.